Advertisement

-

Published Date

June 18, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

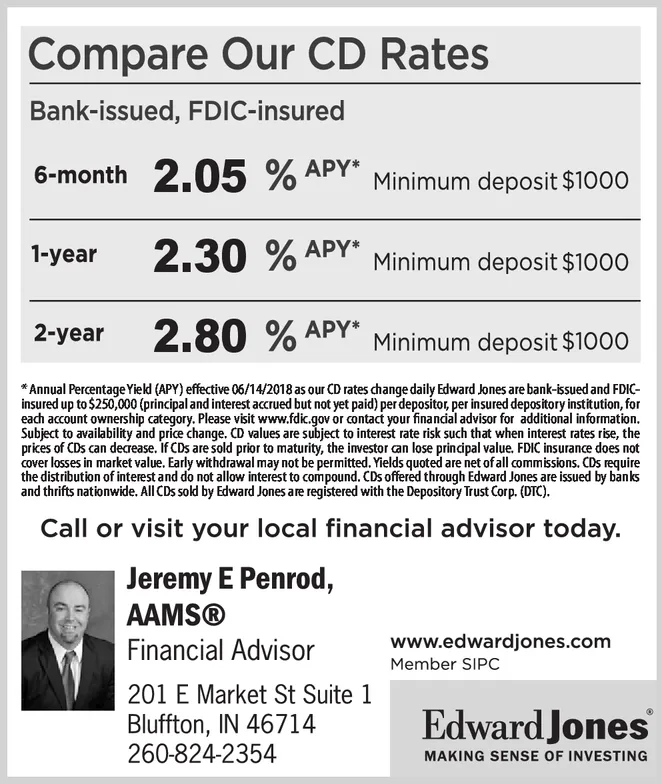

Compare Our CD Rates Bank-issued, FDIC-insured 6-month 2.05 %APY* 1-year 2.30% APY* Minimum deposit $1000 2-year 2.80%APY* Minimum deposit $1000 Minimum deposit $1000 *Annual Percentage Yield (APY) effective 06/14/2018 s our CD rates change daily Edward Jones are bank-issued and FDIC- insured up to $250,000 (principal and interest accrued but not yet paid) perdepositor, per insured depository institution, for each account ownership category. Please visit www.fdk.gov or contact your finanial advisor for additional information. Subject to availability and price change. CD values are subject to interest rate risk such that when interest rates rise, the prkes of CDs can decease. If CDs are sold prior to maturity, the investor can lose prindpal value. FDIC insurance does not cover losses in market value. Early withdrawal may not be permitted. Yields quoted are net ofall commissions. CDs require the distribution of interest and do not allow interest to compound. CDs offered through Edward Jones are issued by banks and thrifts nationwide. All CDs sokd by Edward Jones are registered with the Depository Trust Corp. (DTC) Call or visit your local financial advisor today. Jeremy E Penrod, AAMS® www.edwardjones.com Member SIPC Financial Advisor 201 E Market St Suite 1 Bluffton, IN 46714 Edward Jones 260-824-2354 MAKING SENSE OF INVESTING